Dave Wisniewski has spent about 25 years watching America’s underground infrastructure evolve. But nothing compares to what’s coming next, he says.

“We are entering an opportunity of a lifetime,” said Wisniewski, the vice president of Environmental and Infrastructure Sales at Vermeer, “to really take advantage of all of these different tailwinds.”

As 2025 further unfolds, the U.S. infrastructure sector appears to be entering a moment of convergence. Years of planning, funding allocations and regulatory back-and-forth should start to give way to action. From fiber broadband and AI-driven data centers to power grid modernization and more, multiple sectors are poised to surge.

“It’s all happening simultaneously,” Wisniewski said.

Few are better positioned to observe this moment than Wisniewski, who has supported underground construction industries at Vermeer since 2002. Here are key portions of a discussion with Wisniewski on infrastructure and trenchless technology trends for 2025 and beyond.

Fiber broadband expansion: Is the market ready to surge?

Wisniewski believes it is. The $42.45 billion Broadband Equity, Access, and Deployment program appears to be moving toward implementation. BEAD aims to expand high-speed internet access by funding planning, infrastructure deployment and adoption efforts in unserved and underserved communities across all 50 states and U.S. territories.

In June 2025, the National Telecommunications and Information Administration issued a restructuring policy notice, requiring extra diligence in technology selection and coverage maps. This aims to provide clarity and speed up the permitting process for project releases.

What’s driving your optimism about the fiber market?

Wisniewski: “There’s a lot of what I would consider to be tailwinds in the infrastructure market today. … Probably the most exciting market right now is the telecommunications fiber market. I talk about it in terms of a three-legged stool, if you will, that is going to propel that marketplace. One of those legs is something that everybody in the industry has been talking about — it’s called BEAD.

“We’re waiting to see what the final dollars are that end up in the market and into projects. And we believe we’ll see that sometime late fourth calendar quarter of this year or early next year. So some level of that $42 billion is going to actually make it to projects. Let’s just say if half of it does — that’s $20 billion, which is much more than most federal programs we’ve ever seen combined.”

What other infrastructure developments are you optimistic about?

Wisniewski: “The second leg of the stool is all of this private equity money that is being brought into the market to put in fiber rings around communities. And that money does not require any federal subsidy. It’s just private money being accumulated and put in to construct fiber rings.”

Why AI data centers could fuel a surge in fiber and power infrastructure

Artificial intelligence is driving a massive expansion in data center construction. The U.S. Energy Information Administration projects that data centers could consume up to 12% of U.S. electricity by 2028, up from 4.4% in 2023. This growth is creating booming demand for underground fiber, power infrastructure and cooling systems — all areas where Vermeer industrial equipment plays a critical role.

“It’s an arms race,” Wisniewski said of AI data center development.

How will artificial intelligence energy needs drive business?

Wisniewski: “The last leg of the stool is super exciting — and that’s all of this data center activity. There is a tremendous number of data centers being talked about, being built and constructed today, and there’s a race to get there. And again, it’s private money.

“The construction itself is going to be a big deal to local contractors, but then every one of those data centers is going to be connected to another data center. … And a vast majority of that connectivity is going to be done underground. So that means billions and billions and billions of dollars of installed fiber connecting these data centers, utilizing our type of equipment — whether it be plows or directional drills.

“Data centers consume a tremendous amount of power — tons of power — and water, too, to cool things. So there will be other underground infrastructure brought in, whether it’s gas pipes to run turbines to power the plants, or solar fields to power the facility. We have products that put in the piles, drive the piles, and of course all of the underground infrastructure connected will be put in with our equipment.

“So the three-legged stool is just super exciting. And it’s either underway, or we’re going to get even more of a kick late this year into early next year.”

Power grid modernization: How electrification and resilience are shaping the future

With nearly 70% of the U.S. grid more than 25 years old, according to a 2018 report by Utility Dive, the push includes resilience upgrades, transmission expansion and support for electrification of transport and industry. The Department of Energy has emphasized that modernizing the grid is essential to withstand and recover from extreme weather events, which are increasingly threatening the reliability of the nation’s power infrastructure.

How is power infrastructure evolving?

Wisniewski: “With the electrification of just our country — EV vehicles, charging stations — the grid itself needs to be upgraded. All of those things are going to combine to create a massive opportunity.”

What role do storms and natural disasters play in shaping infrastructure priorities?

Wisniewski: “If you look at the FEMA disaster map and look at the two coasts … there’s super high intensity red for all the things that are going to go on there. But there’s red throughout the entire country. I mean tornadoes, ice storms, hurricanes, derechos, fires … all these things have an impact on the power grid.”

What’s the long-term outlook for infrastructure resilience?

Wisniewski: “Just the protection of that system, the updating of that system and the expansion of that system — all of those things are going to be happening over the next decade.”

Oil, gas and carbon capture: What’s driving renewed optimism for pipeline work?

Oil and gas projects are expected to rebound under a more favorable regulatory environment. Meanwhile, the Department of Energy has reopened a $500 million funding opportunity to expand carbon dioxide transport infrastructure. These developments are creating renewed demand for pipeline directional drills and pipeline trenchers.

What’s the outlook for oil and gas?

Wisniewski: “We started hearing a lot more after the new administration came in. … Projects that didn’t exist six months ago are now active. It almost seemed as if there were projects out there that were put on hold, and once the new administration came in and cleared some of the potential red tape … those projects now appear ready to go.”

What kind of work is being done in that space?

Wisniewski: “Whether it is complete pipeline spreads or resizing of segments of pipeline to get more gas to places — potentially where data centers are going in — there’s going to be a lot of activity.”

What about gas distribution?

Wisniewski: “There’s another area of natural gas called gas distribution — all of the lines that go to the neighborhoods, to the homes, to the businesses. That business certainly seems to be relatively stable … and there’s still a lot of replacement being done in this country. Old pipe — whether it be bare steel, cast iron or even some of the first-generation plastics — needs to be replaced with new product. And that’s being done — the vast majority — with a directional drill.”

And carbon capture?

Wisniewski: “The fact that it’s still being talked about to me says that there’s still viability to it.”

Is solar still a key player in the infrastructure boom?

Despite a 7% year-over-year decline in Q1 2025, solar accounted for 69% of all new electricity-generating capacity added to the U.S. grid, according to the Solar Energy Industries

Association. Utility-scale projects continue to dominate, and the new Vermeer PD25R pile driver is helping meet the automation and efficiency needs of this segment.

What’s our read on the solar industry?

Wisniewski: “The number of projects we’re hearing about is very strong. … Our new pile driver has been very successful. It’s the right product at the right time.”

How does automation play a role?

Wisniewski: “It has a certain level of automation … that works super well in the solar industry where these solar fields are almost like large production settings.”

Residential construction and utility demand: What happens when housing rebounds?

The National Association of Home Builders reported that housing starts dropped 11.4% in March 2025 due to high interest rates, rising construction costs and labor shortages. While the slowdown has impacted residential utility installation, long-term demand remains strong.

How does housing affect business?

Wisniewski: “Every single one of these housing developments is a great opportunity. … Gas, power, water, sewer, telecom — it all needs to be installed.”

Could housing starts rebound in the next couple of years?

Wisniewski: “New housing certainly drives a lot of our businesses. … In most communities that will be established and developed in the United States, you’re going to have a natural gas system, a power system, a water system, sewer system, a cable system. In some cases, they’ll put those into joint trenches, but in a lot of cases, you’re still going to have individual pipes going to the house —services that need to be put in with our equipment.”

What other factors influence housing-related infrastructure?

Wisniewski: “Our businesses at the end of the day are pretty basic: We need power to flip on the switch, gas to cook our food, telecom to connect. But what drives them all is really complex. … There are state regulations, local regulations, federal regulations, interest rates, whether a company’s going to invest in a project or whether someone’s going to buy a new home. All those things ultimately create a drive cycle.”

Is Vermeer ready to support the infrastructure opportunity ahead? Absolutely.

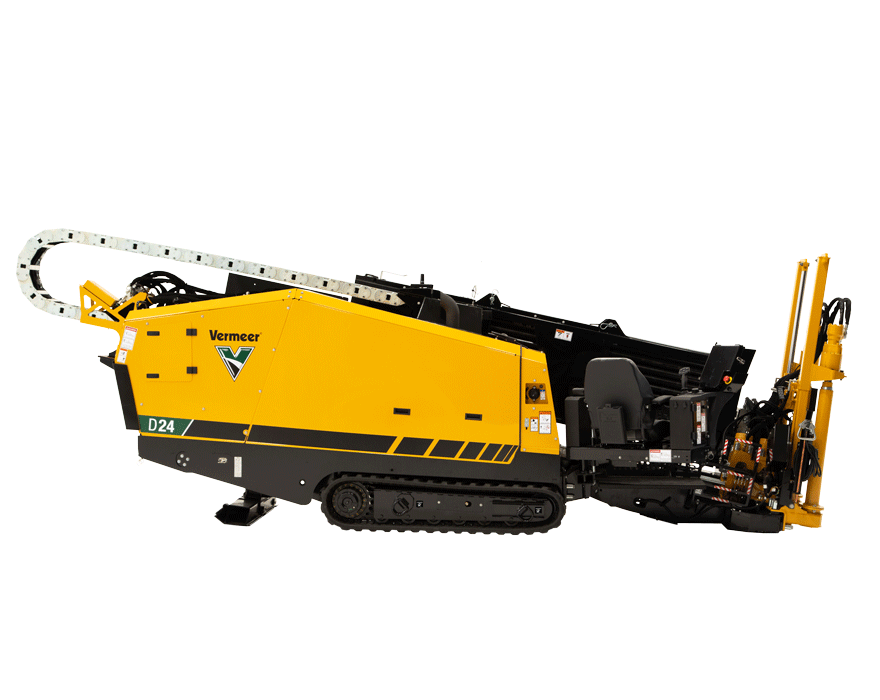

With the recent launches of the D24 horizontal directional drill and the PD25R, Vermeer is well-prepared to meet the increasing demand across various sectors. Supported by a robust dealer network and the new Global Parts Distribution Center, Vermeer ensures you have access to the infrastructure equipment and tooling you need.

What makes the D24 release so timely?

Wisniewski: “The timing of the launch of the D24 is perfectly timed just for what we are facing in the industry in general, which is … the lack of operators. The automation that is part of that drill’s infrastructure is going to lend itself to really easy training of new operators. They’re looking for the ability to diagnose issues on drills quicker, so they can get turnaround and uptime. The way the drill was constructed — to be extremely reliable — those are all things the industry is looking for.”

How is the new PD25R meeting the needs of the solar market?

Wisniewski: “They’re looking for high levels of efficiency, so things that we can do to help automate the work is really beneficial.”

How well is Vermeer prepared for this ‘once-in-a-lifetime’ opportunity?

Wisniewski: “It takes more than just product. … Our distribution network is ready, trained, with inventory and mobile service. That’s going to be one of the most critical parts of this whole thing.

We’ve been readying ourselves for this for a long time.”

Vermeer Corporation reserves the right to make changes in engineering, design and specifications; add improvements; or discontinue manufacturing at any time without notice or obligation.

Equipment shown is for illustrative purposes only and may display optional accessories or components specific to their global region.

Please contact your local Vermeer dealer for more information on machine specifications.

Vermeer, the Vermeer logo and Equipped to Do More are trademarks of Vermeer Manufacturing Company in the U.S. and/or other countries.

© 2025 Vermeer Corporation. All Rights Reserved.